Table of Contents

It’s that time of year again, when the tax year draws to a close and visions of refunds checks dance in our heads. If you’ve been running behind financially, it’s easy for that refund check to disappear as quickly as it arrives, leaving you little or no better off than you were before.

When you’re in a financial bind, it can be hard to think about the future. But, if your budget isn’t stable, it’s all the more important to think strategically about how that influx of cash can best serve you and your family.

Should you pay off your credit cards? Take a quick trip to Hawaii? Create an emergency savings account? Are you thinking about pre-spending your tax refund with a Christmas splurge, knowing that large deposit will help you catch up in January?

Here’s what others are planning for their 2021 tax refund checks, and what you should consider before deciding how to spend or invest yours.

2021 Tax Refund Plans

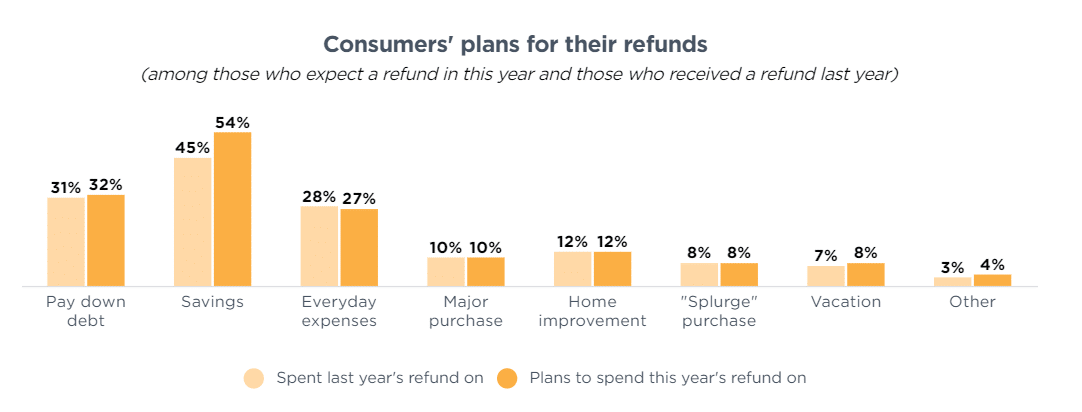

Every year, the National Retail Federation (NRF) surveys consumers about when they plan to file their tax returns, whether they’re expecting a refund, and how they plan to spend that money. The 2021 results are an interesting mix.

54% of respondents said they planned to use some or all of their tax refunds to start or build savings. That’s the highest percentage since NRF started the survey in 2009. At the same time, the percentage of people planning to use their tax refunds to pay down debt–32%–is at its lowest point in the survey’s history.

That sounds promising, and there are some possible explanations. Covid relief measures helped some people catch up on bills and pay down debt, perhaps leaving more people free to save their tax refund checks this year. At the same time, though, 27% said they planned to use the money to pay “everyday expenses.” That’s the highest percentage since 2013.

Vacation plans and plans to “splurge” are down. But, the percentage planning to invest in home improvements has increased slightly, from 10% in the two most recent years to 12% in 2021.

For many people, multiple needs and wants may be competing for tax refund funds. If that’s true for you, stop, calculate, and plan before you direct that money.

Determining the Best Use for Your Tax Refund

For some people, there’s a clear problem to be solved when the next tax refund arrives. Maybe it’s a much-needed car repair, or the need to catch up on past-due rent, or a medical procedure you’ve been postponing because it’s too expensive.

For everyone else–and for those who will have some money left over after attending to an urgent need–it’s time to strategize.

Savings vs. Paying Down Debt

One common pair of competing interests is the need to establish emergency savings versus the opportunity to eliminate the ongoing stress and expense of debt payments. The first thing to remember is that it isn’t necessarily an either/or scenario. You may be able to set aside enough to start your emergency fund and provide yourself a little buffer while still making meaningful progress toward paying down debt.

Imagine, for instance, that you have two credit cards, each with a balance of about $1,200. You’re making minimum payments each month, but the balances don’t seem to move much. If your tax refund is $2,500, you could pay off the debt in full. Or, you could start a nice savings account and continue to make monthly credit card payments.

But, there’s a third option: you could pay off the credit card with the higher interest and still have more than $1,000 to start your emergency fund. Think twice before you close that credit card account, though–it’s generally better for your credit score to keep the account open with no balance or a low balance.

You’ll cut the monthly interest charges you’re accruing by more than 50% just by paying off the higher-rate card. Then, you can redirect the amount that was going to that account each month to the other. That means you’ll be paying more than the minimum payment, and will be able to pay off the balance faster and pay less interest.

The best way to allocate those funds depends on the specifics of your situation. The key is to carefully consider what will benefit you the most before you start making payments.

Exploring Longer-Term Solutions

In the example above, the amount of outstanding debt is relatively small, and the tax refund offers a good opportunity to take control. But, that isn’t always the case.

If your debts are larger and you’re having trouble keeping up payments, your tax refund could provide a good opportunity to take more significant action.

For instance, if you have significant unsecured debt such as credit card debt, payday loans, unsecured personal loans, old utility bills, and medical debt, this may be a good time to learn more about Chapter 7 bankruptcy.

Depending on your circumstances, income, and other factors, it’s possible that investing your tax refund in clearing debt through Chapter 7 could mean a much brighter financial picture in 2022.

To learn more, schedule a free, no-obligation consultation with one of the experienced Los Angeles debt resolution attorneys at Borowitz & Clark. Just call 877-439-9717 or fill out the contact form on this site to get started.

If you’re already working toward Chapter 7 bankruptcy, consider taking this opportunity to accelerate the process and achieve financial freedom sooner.