Table of Contents

Some Chapter 13 bankruptcy filers can discharge some or all of their unsecured debt after successfully completing the Chapter 13 repayment plan. But, some people have too much disposable income to be eligible to discharge debt in a Chapter 13 case. Often, those individuals or married couples can still file for Chapter 13 bankruptcy, but will be required to pay 100% of their unsecured debts through the plan.

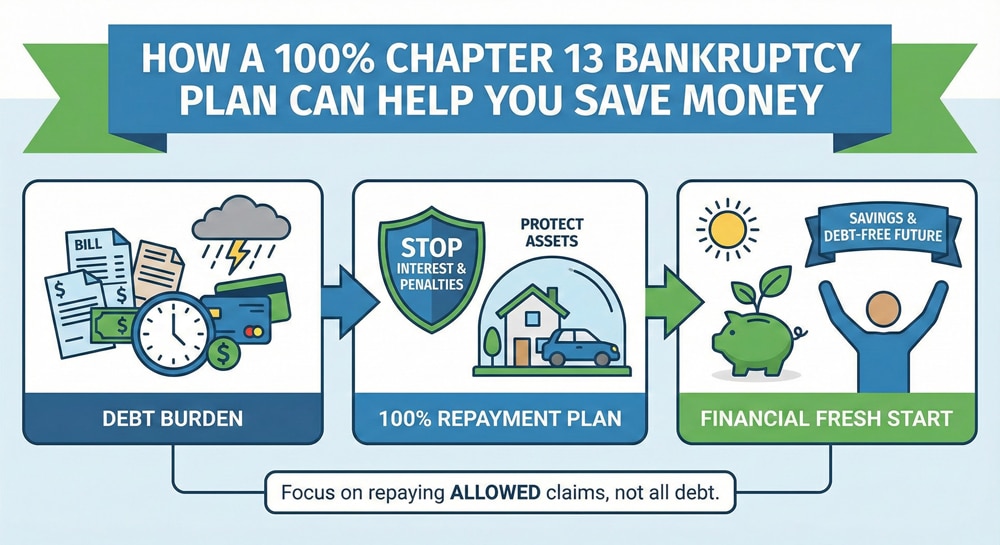

If you’re wondering why you would bother to file Chapter 13 if you’re going to have to pay all of your debts anyway, you’re not alone. But, there are two significant possible benefits: crisis management and substantial savings.

Two Ways Chapter 13 Bankruptcy Can Help

Crisis Management through Chapter 13 Bankruptcy

Sometimes serious financial problems come down to timing. Maybe you’re behind on your mortgage and just got back to work, but the lender won’t work with you to catch up over time. Or, maybe you’re facing vehicle repossession in a matter of days, or have been served with notice of a wage garnishment that will destabilize your finances.

Chapter 13 bankruptcy can put the brakes on those processes. In almost every case, an automatic stay is entered as soon as the case is filed. The stay order tells creditors and debt collectors to stop any collection action. You’ll submit a plan for repaying your past-due balances over time. When your repayment plan is confirmed, that order will remain in effect for as long as you keep up your payments and otherwise follow the rules.

That means a Chapter 13 case can often help someone who has suffered a setback avoid foreclosure, repossession, and other disruptive collection actions.

Of course, not everyone looking for a better way to manage debt is facing an emergency situation like a pending foreclosure. If you have time to take a more strategic approach, you may still find that Chapter 13 bankruptcy offers big benefits–even a 100% plan.

Chapter 13 Bankruptcy Can Save You Money–Sometimes, a Lot of Money

Paying 100% of your unsecured debt through a Chapter 13 plan looks a lot different than paying 100% of the same debt directly. That’s because, in a Chapter 13 plan, 100% means 100% of the balance you owe when you file. When you’re making payment directly, it means 100% of the amount you owe when you file plus interest–potentially years of interest–and perhaps additional fees, as well.

You may be surprised to find out just how much of a difference that can make.

Imagine, for example, that you owe $45,000 in credit card debt.

In a Chapter 13 plan, you’d pay about $907/month toward that debt for 60 months. That includes fees paid to the bankruptcy trustee. The debt would be paid in full in five years, and you’d have paid a total of about $54,420 to settle that $45,000 debt.

The average credit card interest rate in California is 16.16%. If you’re paying 16.16% interest on that $45,000 balance and you pay that same $907/month toward your credit card debt, it would take 83 months to pay off the debt. That’s nearly two years longer than the Chapter 13 plan. More importantly, you’d pay $29,791 in interest, for a total of $74,791. That’s an extra $20,000+ compared with the Chapter 13 plan. And, that’s assuming that you make all of your payments on time and don’t incur any additional fees.

That’s a big difference, but it’s also an optimistic example for a couple of reasons.

First, while the initial minimum payment on $45,000 would be about $900/month, minimum payments are typically calculated based on the outstanding balance. 2% of the balance is a common formula. So, the minimum payment drops over time. If you make only the minimum payment instead of a steady $907/month, it would take 771 months to pay off that $45,000 balance. That’s just over 64 years. If you live long enough to pay off the balance, you’ll have paid more than $130,000 in interest, for a total of more than $175,000.

The other variable is the interest rate. While 16.16% is the average rate for Californians, many people struggling with debt are paying higher interest rates…sometimes much higher. Bumping up the interest rate to just 19% increases the number of minimum payments to payoff to 1,178, or 98 years and a whopping $214,598.53 in total cost. Again, that’s assuming no late charges or other fees.

In short, paying that debt through a 100% Chapter 13 plan could save you tens or hundreds of thousands of dollars. And, a successful Chapter 13 plan would resolve that debt in five years, versus potentially making payments for decades.

Would a Chapter 13 Plan Help You Regain Control of Your Finances?

The best way to find out is to speak with an experienced Los Angeles bankruptcy attorney. The attorneys at Borowitz & Clark offer free consultations to help you make good decisions for your financial future. You can schedule yours right now by calling 877-439-9717 or filling out the contact form on this site.