Table of Contents

If you’ve never heard of debt parking, you’re far from alone. In fact, secrecy is exactly what makes debt parking such a problem for consumers in Los Angeles and around the country.

Here’s the short version of how it works:

- A debt collector or debt buyer takes on a debt. Often, this is a shady debt. Maybe the records are fuzzy or unavailable. Maybe the debt is too old to legally collect. In extreme cases, the debt may even be fake.

- Next, the debt collector or buyer reports the debt to one or more of the three major credit reporting agencies.

- Then, the debt collector does nothing.

This process is sometimes described as passive debt collection, since the debt collector or debt buyer simply reports the debt and then waits.

The debt sits on your credit report or credit reports until you notice it. Likely, your credit score drops. If you’re monitoring your credit report or you do periodic checks, you may discover the debt and dispute it. But, most people don’t. If you’re diligent about your credit, it may surprise you to learn that one recent study showed just 33% of Americans had checked their credit reports in the preceding year.

That means many people never notice these items until someone else checks their credit. That someone else might be a mortgage lender or a potential employer. Suddenly, your future plans are in jeopardy due to a debt that you didn’t even know about – a debt you may not owe or that may be legally uncollectible.

By this point, many people in this situation are stuck. If they’ve been aware of the entry and their credit reports earlier, they could have disputed. But now, there may not be time for that. Too often, people end up paying these debts because it is the only way to keep their loan application or hiring process or other important procedure moving forward.

That’s great news for the debt buyer or debt collector and simplifies things for the lender or prospective employer. But, it’s bad news for the consumer who feels forced to pay a debt they may not be responsible for. And, it’s bad news for society, because when shady tactics like this are successful, collectors keep using them.

Debt Parking is Illegal

Both the Federal Trade Commission (FTC) and California’s Department of Financial Protection and Innovation (DFPI) have taken action against debt collectors that engage in debt parking.

The FTC recently settled its action against Midwest Recovery, which alleged that the company had committed various violations, including violating the FTC Act, the Fair Debt Collection Practices Act (FDCPA), and the Fair Credit Reporting Act (FCRA) through debt parking. The agency’s complaint said between 2015 and 2020, the company had reported $98 million in questionable or outright invalid debt to credit reporting agencies. These items included:

- Unauthorized payday loan debt

- Debts that were in bankruptcy or been discharged in bankruptcy

- Debts with inaccurate balances

- Debts that had been paid by the consumer

- Medical debts that were in the process of being re-billed to insurance

- Debts that were the subject of pending fraud claims

The FTC says about $24 million in debt was collected. And, Midwest Recovery allegedly accepted those payments knowing that when consumers did dispute this type of debt with their company, 80-97% of it was either inaccurate or unverifiable.

The California enforcement action is still pending, and alleges that F&F Inc violated the California Consumer Financial Protection Law (CCFPL) through debt parking and unlawfully threatening legal action and wage garnishment. This is the first enforcement action filed by the recently-established DFPI.

Credit Monitoring is Your Best Defense against Debt Parking

The FCRA and other federal and California laws provide a way to fight back when a debt collector or debt buyer slips an alleged debt onto your credit report without notifying you of the debt. Credit reporting agencies and furnishers must investigate and correct or delete inaccuracies when a consumer disputes a credit report entry. But, you can’t dispute what you don’t know about.

If you don’t find out about parked debt until you’re in the process of buying a car, applying for an apartment, or another important life event, you may be forced to choose between asserting your rights and moving forward with your purchase. This is just one of many reasons it’s important to check your credit report regularly. Others include:

- The increased frequency of identity theft in recent years

- Other shady debt collection practices, such as re-aging debt to keep it on your credit report longer

- Honest mistakes: one study showed that more than 20% of consumer credit reports contained errors

Checking your credit reports is a relatively quick and easy process that’s well worth the investment.

What if the Debt is Real?

A debt collector or debt buyer may still be liable for violating one or more consumer protection statutes if the company has illegally parked the debt, even if it’s valid. However, that won’t erase the debt (though it may give you negotiating power).

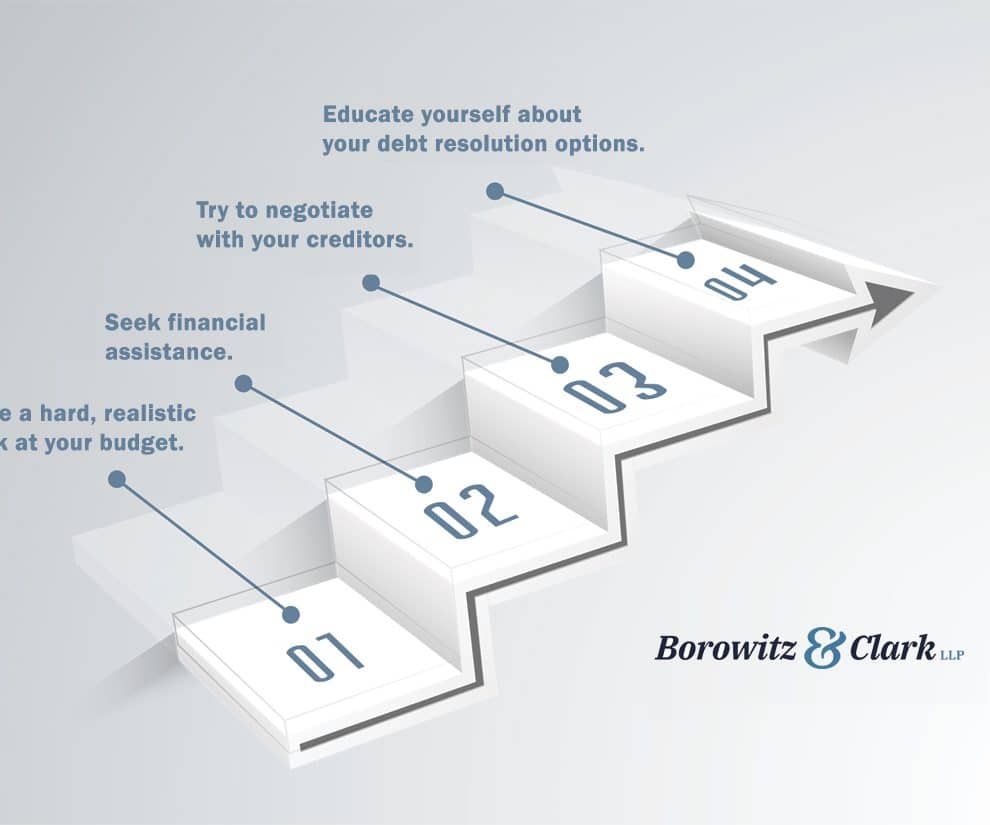

How to address valid debt that’s hurting your credit history depends on your specific situation. You may be able to negotiate a settlement for less than the full amount of the debt, refinance the debt by taking out a loan to pay it off, or enter into a payment arrangement. Or, if the debt is unmanageable, you may want to consider bankruptcy.

At Borowitz & Clark, we’ve been helping people resolve debt for decades. If you have more debt than you can manage and want to learn more about your options, call us at 877-439-9717. The initial consultation is free.

Other Articles Related to Debt Collection

Download our free eBook

The Top 10 Myths About Bankruptcy in California

Enter your name and e-mail address below to get the free eBook.

"*" indicates required fields