Credit card debt in the U.S. declined slightly in Q1 of 2022, but the New York Federal Reserve described the $15 billion drop as a “typical seasonal decrease.” Credit card balances tend to run high around the holidays. More significantly, aggregate credit card balances remain higher than throughout the pandemic.

Table of Contents

Despite the huge number of credit card account closures during the pandemic, the number of open credit card accounts in the U.S. is at a record high, with well over 500 million accounts. That’s an aggregate credit limit of more than $4 trillion, up about $224 billion from before the pandemic.

At the same time, delinquencies are increasing. The percentage of credit card accounts that were 30+ days past due dropped from early 2020 through the end of 2021, but ticked upward in Q1 of 2022. Similarly, accounts 90+ days past due were down throughout 2021, but surged slightly in Q1 of this year. The youngest and oldest borrowers were most affected: delinquency rates increased among credit card account holders aged 18-29, 30-39, and 70 and older.

For some U.S. credit card holders, it’s about to get worse.

Increasing Credit Card Interest Rates

You’ve probably heard that the Federal Reserve is raising interest rates in an effort to combat inflation. While we’d all like to see lower prices–or, at least, an end to the steady increases–higher interest rates come at a price. While most of us recognize that the interest rate hike means we can expect to pay higher interest rates if we finance a car, take out a mortgage loan, or refinance our homes, many don’t realize that interest rates on your existing credit card account may also jump.

Average Credit Card Interest

A report released by LendingTree in mid-June revealed that the average new credit card interest rate in the U.S. at that point was 20.17%. This is the first time since LendingTree started tracking data in 2018 that the average rate on new credit card accounts was over 20%. And, there are more interest rate hikes to come.

The average interest rates on current credit card accounts are much lower: 14.56% for all accounts and 16.17% for those accruing interest. The latter figure is actually lower than it was in mid-2021. But, there’s more change to come. And, not everyone will be impacted equally.

An expert tip from Barry

Interest Rates Vary Based on Your Credit Score

There isn’t a standard credit card interest rate offered by a particular card issuer. Instead, interest rates are determined in part by how risky it is to extend credit to you. That means if you have a history of missed payments, a low credit score, or other risk factors, you can generally expect to pay more interest.

For example, while LendingTree reported an average rate of 20/17% for new credit card offers, that figure represented a range of rates from 13.08% to 25.18%.

When Credit Card Interest Rates Change

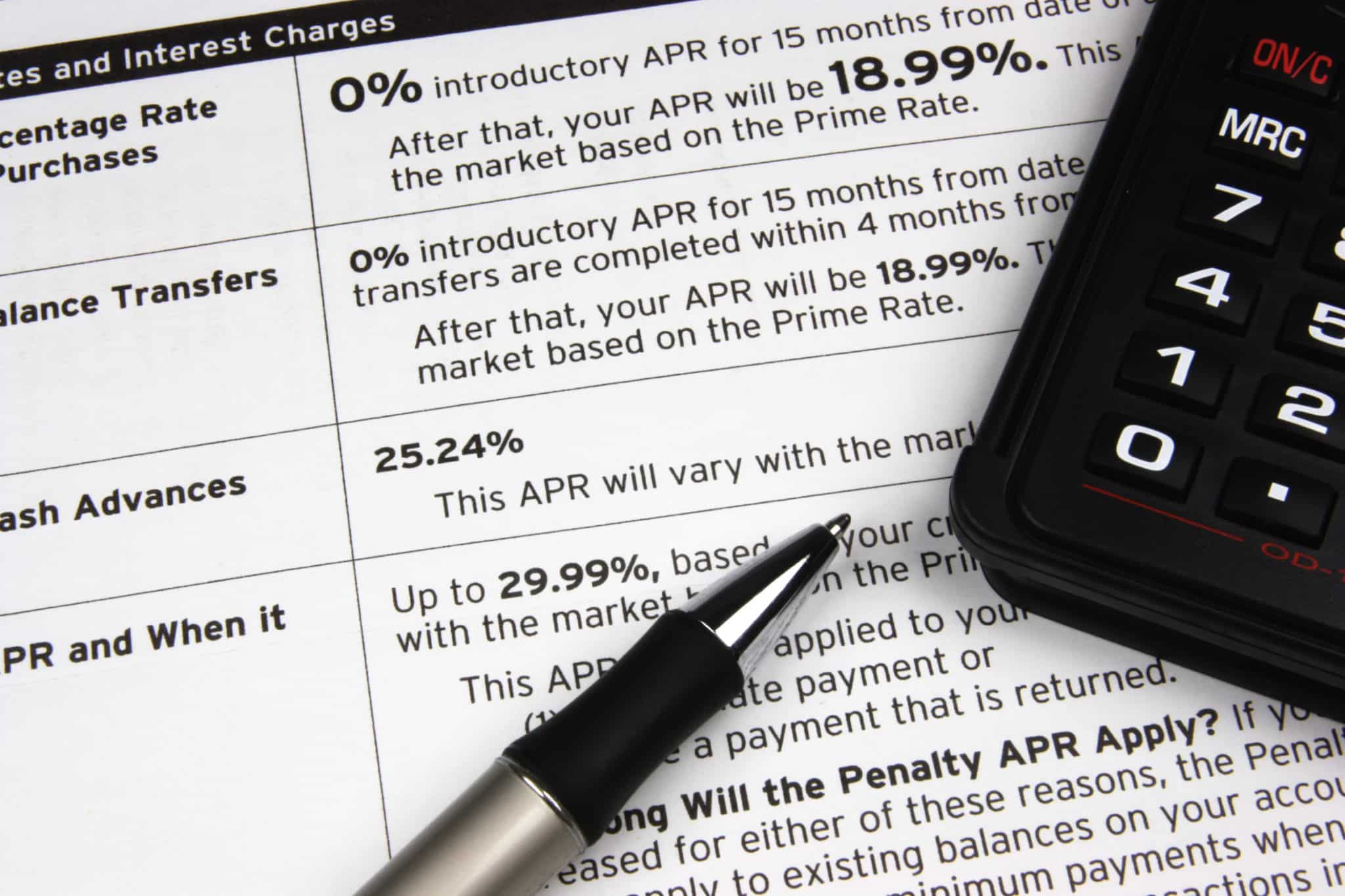

Variable Interest Rate Cards

Chances are you have a credit card with a variable interest rate. But, you may not even know it. With a variable rate credit card, interest rates fluctuate with the prime lending rate. The prime rate rises and falls in connection with the federal funds rate. Under normal circumstances, most people won’t notice the changes. That’s because the Federal Reserve normally makes small changes.

The committee that recommends these changes meets about once every six weeks. Tweaks to the federal funds rate, when they happen, are usually in .25% increments.

But, in mid-June, the Federal Reserve raised that rate by .75%, and signaled that it’s likely another increase will be recommended at the late July committee meeting.

So far, the increase is less than 1%, and that probably doesn’t sound like much. Here’s how it might play out with an outstanding credit card balance of $10,000:

At an 18% interest rate, making minimum monthly payments, it would take 342 months to pay off the balance. The total interest paid would be $14,423, for a total payout of $24,423.

At the same interest rate, monthly payments of $260 would mean 58 months (four years and 10 months) of repayment. Total interest would be $5022, for a total repayment of $15,022.

From this example, you can see the downside of making minimum payments, regardless of your interest rate. But, what happens when that rate jumps by just 1%?

At a 19% interest rate, making minimum monthly payments, it would take 344 months to pay off the balance. Total interest would be $15,239, for a total repayment of $25,239.

At the same interest rate monthly payments of $260 would mean 60 months (five years) of repayment. Total interest would be $5,541, for a total repayment of $15,541.

With the fixed payments (clearly the better option), the cardholder with a 19% interest rate pays more than $500 extra in interest and makes payments for an extra two months. Of course, the difference increases as interest rates climb higher.

Fixed-Rate Credit Cards

If you happen to have a fixed-rate credit card, you may think you’re insulated from this type of change. To a degree, that’s true–but not to the extent you might expect.

First, most fixed-rate cards include a provision allowing the company to raise your interest rate on existing balances if your account is more than 60 days past due. There are some limitations, though, including that the company must reinstate your original rate after six months of on-time payments.

A credit card issuer may also raise your rate on new purchases at any time, as long as they provide at least 45 days notice.

Preparing for Credit Card Rate Increases

With rates on new card offers already rising and the prime rate expected to climb again later this summer, many Americans can expect higher credit card interest rates. That means higher minimum payment requirements, more interest added to any balance you’re carrying each month, longer repayment periods, and more net interest paid.

The best solution, of course, would be to pay off your credit cards as soon as possible. If you’re not carrying a balance, you’re not accruing interest. But, that’s not always an option. If you can’t go that far, consider:

- Increasing monthly payments to reduce the balance you’re paying interest on;

- If your credit is good, seeking out a lower rate credit card or one with a low or 0% introductory rate and transferring your balance (you generally won’t want to close the original account, though, since both the age of your credit accounts and your available credit impact your credit score);

- If your credit is good, look into the possibility of a fixed-rate loan with a lower interest rate to pay off outstanding credit card balances; or

- If your credit card debt and/or other debt is overwhelming, consider a longer-term solution such as bankruptcy

Need help resolving your credit card debt? At Borowitz & Clark, we’ve been helping people in and around Los Angeles regain control of their finances for decades. We offer free consultations to help you get the information you need to make the right decision for your future. To schedule yours, call 877-439-9717 or fill out the contact form on this page.