Sneaky Security

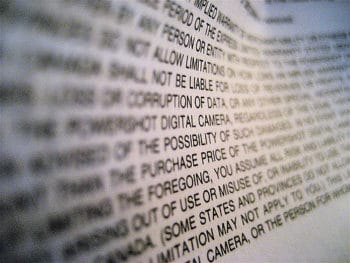

When you get a credit card, it comes with an agreement that includes all the terms that affect how you can use the card, how you pay it, what interest rate you’ll incur, and so on. Of course, those agreements are usually very long and full of legalese and we all know what’s in them – pay it off in full or pay it back over time with interest. We very rarely read the details of those terms and conditions. But credit card companies know that and some of them have started to put in clauses that seriously impact your rights. For example, they may put in a clause that gives them express permission to seize property that you purchased with your credit card if you don’t pay.

Consider the story of Larry Maizlish. Larry admits that he rarely looks at the fine print associated with his credit cards but during a recent review of the fine print on his credit card agreement, he discovered just that clause. His card actually allowed company representatives to take items that were purchased if the bills were not paid.

A clause like this makes a big difference in the way your card works. You may face repossession of your property over an unpaid credit card debt, which is not possible with a standard credit card agreement. Under a standard agreement, your credit card issuer has to either negotiate a settlement or sue you for collection if you don’t pay. With a clause that turns your purchases into collateral, they can simply take back what you bought.

That’s because your credit card debt is now secured debt instead of unsecured debt. We typically know whether debt is secured or not up front. When you sign a car loan or a mortgage loan, for example, it explicitly states that the lender can take back your car or foreclose on your home if you don’t pay. But we don’t expect that from our credit cards.

The threat of repossession is a big deal, but it’s not the only issue. When you file a bankruptcy, your unsecured debts and secured debts are treated differently. Your unsecured debts will be wiped out. Your secured debts, on the other hand, go through a different process and won’t just be washed away. You’ll have to decide whether to give up the property or enter an agreement with the lender to keep paying and keep your purchases. That may change the process for deciding whether to file bankruptcy and which type to file. A Chapter 7 bankruptcy is a great way to take care of your unsecured debt but a Chapter 13 is better if you need to keep the property linked to your secured debts. And you don’t want to get halfway into the bankruptcy process only to find that your credit card debts aren’t what you thought they were.

What About Your Fine Print?

Comenity, the company that issued Larry Maizlish’s card, is securing all credit card loans with the items that cardholders put on their card itself. This kind of practice became unpopular in the 1990s after Sears was forced to pay more than $270 million in refunds to customers using it. Comenity, however, has never given up the practice. It’s actually a leading issuer of store cards, including managing the credit lines for retailers like Pottery Barn, Ann Taylor, J. Crew, New York & Company, Lane Bryant and many more.

This company may not be the only one. When was the last time you went through all your agreements with your card company? Most people never take the time to do this, but it could end up costing you.

It’s probably not worth the time or expense for a lender to repossess things you’ve purchased with your card, but they can use that threat as leverage to force you to pay them back over other debts. And they do have the right to follow through on that threat.

However, those individuals might take notice if their recently purchased items were up for grabs by the company. A big enough purchase might make it worth the company’s while to send someone on and to repossess the item.

Keep in mind, however, that you do have rights with regard to this situation. As outlined in California Commercial Code Section 9609, collateral could only be collected by a creditor without breaching the peace. This means that repossession men can’t enter your home without permission and if you do refuse to gain them entry then their only option is to turn to the courts.

The company’s willingness to go to court over the bill or items depends a lot on the value. Cheaper goods simply won’t make it worth having to hire an attorney and go through the process. You can look up the database of card agreements organized by the Consumer Financial Protection Bureau to determine whether or not your credit card contract has a provision like this.

The best way to protect yourself is to avoid having a card like this in the first place. When you’re shopping around for a new credit, make sure you conduct comprehensive research. It’s about more than looking for who will give you the most points or the best APR. You want to ensure that the company also protects your rights and that you aren’t signing over any unreasonable rights just to get that plastic. Check out the database listed about before you sign on the dotted line for that new credit card. Doing this alone could help prevent being stuck in an agreement you’re not on board with. If you already have a card like this, you might want to think about paying it off and closing it if you have other options.

Image Credit and License