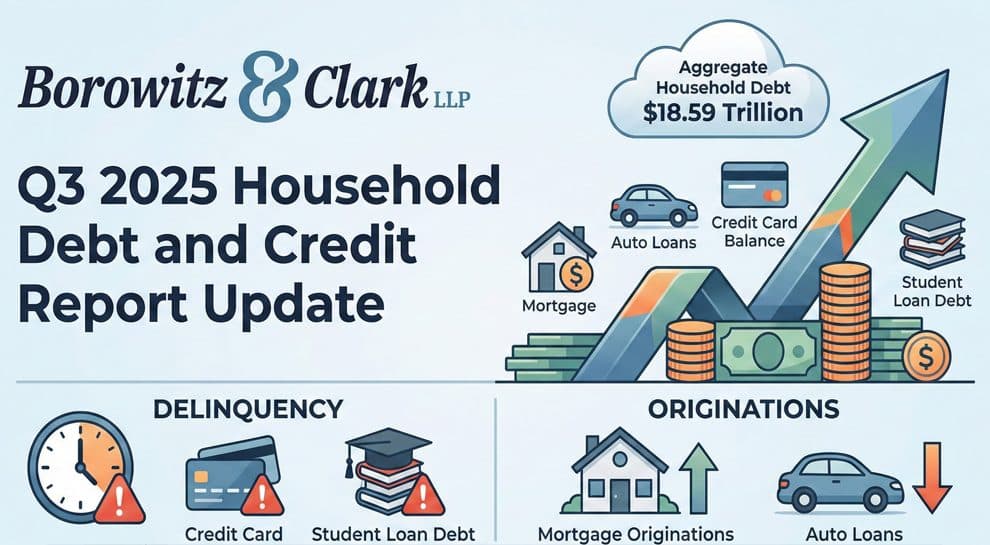

Explore the latest insights from the Household Debt and Credit Report. Understand trends in mortgage, auto loans, and credit card debt.

Published

When people hear the word bankruptcy, they often imagine shuttered storefronts, liquidation sales, and total financial collapse. But for most individuals and families, that picture couldn’t be further from reality.

Published

Your 401(k) plays a critical role in protecting your future, and that role is growing. NPR recently reported that the Social Security trust fund is on track to run out of money in just eight years. That means that unless something changes, tens of millions of Social Security recipients will lose a chunk of their benefits.

Published

Online buy now, pay later (BNPL) shopping options made their appearance in the early 2010s, and mainly offered a way to purchase larger-ticket items such as electronics, retail furniture, and other goods the purchaser might otherwise not have been able to buy on the spot. The plans worked a lot like the old-fashioned layaway plans in department stores, with two important differences: you got the product right away, and you paid a premium for the privilege.

Published

Discover 20 statistics you should know about bankruptcy and debt. Understand the truth behind bankruptcy cases in the U.S.

Published

If you don’t know what an adversary proceeding in bankruptcy is, you’re far from alone. Only a small percentage of Los Angeles bankruptcy filers file or face an adversary proceeding. The rate of adversary proceedings has picked up in 2025, though. In the Los Angeles Division, a total of 289 adversary proceedings were filed in 2024. As of mid-July, the count for 2025 stands at 313.

Published

Since 1998, student loan debt has been non-dischargeable in bankruptcy unless the borrower could establish that paying back the loan would create an undue hardship. That’s still true. Now, though, DOJ lawyers have some clear, detailed, and much more borrower-friendly instructions about what constitutes undue hardship.

Published

When you’re struggling with debt, it’s surprisingly easy to find reasons to delay solutions. Though the sense of urgency never fully leaves you, there’s always something standing in the way. Sometimes it’s that you’re scrambling too hard, working extra hours and juggling bills, to stop and take stock. Sometimes it’s that you’re hoping your next tax refund or year-end bonus or that raise you should be getting in the spring will solve your problems.

Published

We’re proud to share that our attorney, M. Erik Clark, has been selected as the 2025 Calvin Ashland Attorney of the Year by the Central District Consumer Bankruptcy Attorneys Association (CDCBAA).

Published

Student loan debt was put on pause in March of 2020, at the beginning of the pandemic. In the five years since, the pause was extended multiple times. Most borrowers were technically required to start repaying in October of 2023, but the pressure was low. There were no penalties for delinquency in the early months, and the Department of Education (DOE) wasn’t pursuing involuntary collections.

Published