Bankruptcy can be a powerful tool for regaining control of your finances. But it’s not your only option. Most people who ultimately file for bankruptcy protection spend years struggling with finances before they file. For most, that time could be better spent. If you’re weighed down by debt but not sure you’re ready to consider bankruptcy, try these steps.

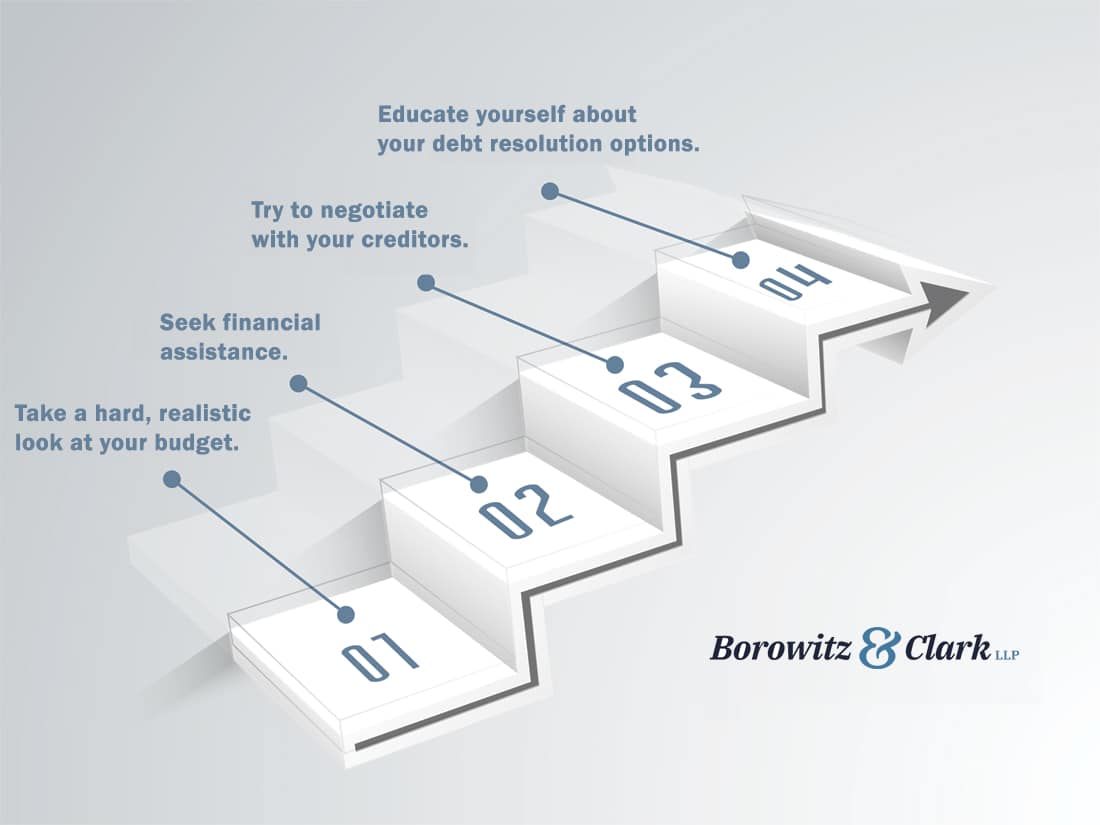

1. Take a hard, realistic look at your budget.

Too often, people struggling with debt have a general sense that their next tax refund or an upcoming raise will fix the problem. Unfortunately, that’s rarely true. One key reason it doesn’t work out is that managing your finances requires precise math.

Any time you’re having a hard time keeping up with expenses and paying debt, you should inventory and calculate. Know exactly how much money you have coming in each month, how much you are spending, and what you’re spending it on. If your expenses are higher than your income, consider whether you can cut costs or increase income. Never try to make financial decisions without hard numbers.

2. Seek financial assistance.

Whether financial assistance is available and what type of help you should pursue will depend on your circumstances, but many people who qualify for help with utilities, property tax breaks, forgiveness of medical bills and other types of assistance miss out because they don’t know their options or assume they won’t qualify.

For example, many hospitals offer financial assistance that can mean a big decrease in your bill, or even a complete write-off. If you’re having trouble making ends meet, make sure you fully explore your options.

3. Try to negotiate with your creditors.

Negotiating with creditors is rarely sufficient to solve long-term financial problems. However, if you’ve fallen behind due to a gap in employment, a serious illness, a divorce or some other disruptive life event, you may be able to work out a resolution directly with creditors.

Depending on the creditor, they may offer options such as lower payments for a limited time, skipped payments, or reducing your balance in return for a lump-sum payment or a short-term payment plan. Debt buyers are often willing to make substantial reductions in return for quick payment, since they have often purchased the debt for far less than you owed.

You should know that debt that is forgiven may be considered taxable income, so be sure to factor that in when deciding whether to settle debt and calculating how much you’ll be saving.

4. Educate yourself about your debt resolution options.

If you’ve decided it’s time to get help with your financial situation, the options can be overwhelming. It’s easy to get sucked in by promises like “cut your debt in half!” Every possible solution has pros and cons. For example, debt settlement may reduce your balances, but those late-night television ads don’t tell you that your debts will continue to grow and your credit will continue to worsen during the two years or more you’re working your way through the program.

Invest the time to learn about your options before you make any decisions, and be sure to consider both the benefits and the costs.

Start with a Los Angeles Bankruptcy Attorney

The best way to determine whether Chapter 7 or Chapter 13 bankruptcy might be the answer for you is to talk to an experienced bankruptcy lawyer about the specifics of your situation. The

attorneys at Borowitz & Clark have decades of experience helping people in and around Los Angeles take control of their finances. The best part is, if there’s a better solution to your situation than bankruptcy, they will explain it to you in detail.

To schedule a free consultation, call us today at 877-439-9717 or fill out our contact form.